Sole Proprietor Income Tax Malaysia

Tax on its US. Inheritance tax consequences of terminating a trust.

Business Income Tax Malaysia Deadlines For 2021

Form P Income tax return for partnership Deadline.

. A reduced rate including exemption may apply if there is a tax treaty between the foreign persons country of residence and the United States. 1 online tax filing solution for self-employed. Form B Income tax return for individual with business income income other than employment income Deadline.

41 A person ie. Self-Employed defined as a return with a Schedule CC-EZ tax form. Winding up a trust.

A sole proprietorship also known as a sole tradership individual entrepreneurship or proprietorship is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entityA sole trader does not necessarily work alone and may employ other people. A company limited liability partnership or a sole proprietor may incur adjusted business losses after deducting. Capital gains tax consequences of terminating a trust.

Sole Proprietor vs LLP vs General Partnership vs Company in Malaysia an individual operating as Sole Proprietor two or more persons in Partnership. In the forms tax classification box if youre taxed as a disregarded entity see the definition above check the individualsole proprietor box not the limited liability company box. Of the Income Tax Act 1967.

The SME company means company incorporated in Malaysia with a paid up capital of. 30042022 15052022 for e-filing 5. Tax saving options on trust.

Section 138A of the Income Tax Act 1967 ITA provides that the Director General is. If youre an LLC with more than one owner youre automatically taxed as a partnership and should select the LLC box using the letter P for partnership. INLAND REVENUE BOARD OF MALAYSIA.

Income tax return for individual who only received employment income Deadline. The following Trusts and Inheritance Tax guidance note Produced by Tolley provides comprehensive and up to date tax information covering. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

Real property means any land situated in Malaysia and any interest option or other right in or over such land. SSM for Sole Proprietor Partnership Private Limited Co. Tax on Company On the first 500K 20SME After 25.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Standard Chartered Bank Malaysia Berhad makes no warranties representations or undertakings about and does not endorse recommend or approve the contents of the 3rd Party Website. Translation from the original Bahasa Malaysia text.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Resident means resident in Malaysia for the purposes of the Income Tax Act 1967 except that references to basis year or basis year for a year of assessment in that Act shall be read as references.

Income Tax Status Income Tax Rate. Source income received by a foreign person are subject to a US. Latest income tax notice of assessment or latest 6 months CPF Contribution history statement.

Have a minimum annual income of RM24000 or RM2000 per month A guarantor is required subject to the banks assessment You can apply as an individual applicant or non-individual applicant sole-proprietor partnerships public listed companies societies etc. Tax rate of 30. 30062022 15072022 for e-filing 6.

Most types of US. Self-Employed defined as a return with a Schedule CC-EZ tax form. Generally a foreign person is subject to US.

When does a trust come to an end. The sole trader receives all profits subject to taxation. 30 JUNE 2022.

Business Income Tax Malaysia Deadlines For 2021

Individual Income Tax In Malaysia For Expatriates

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

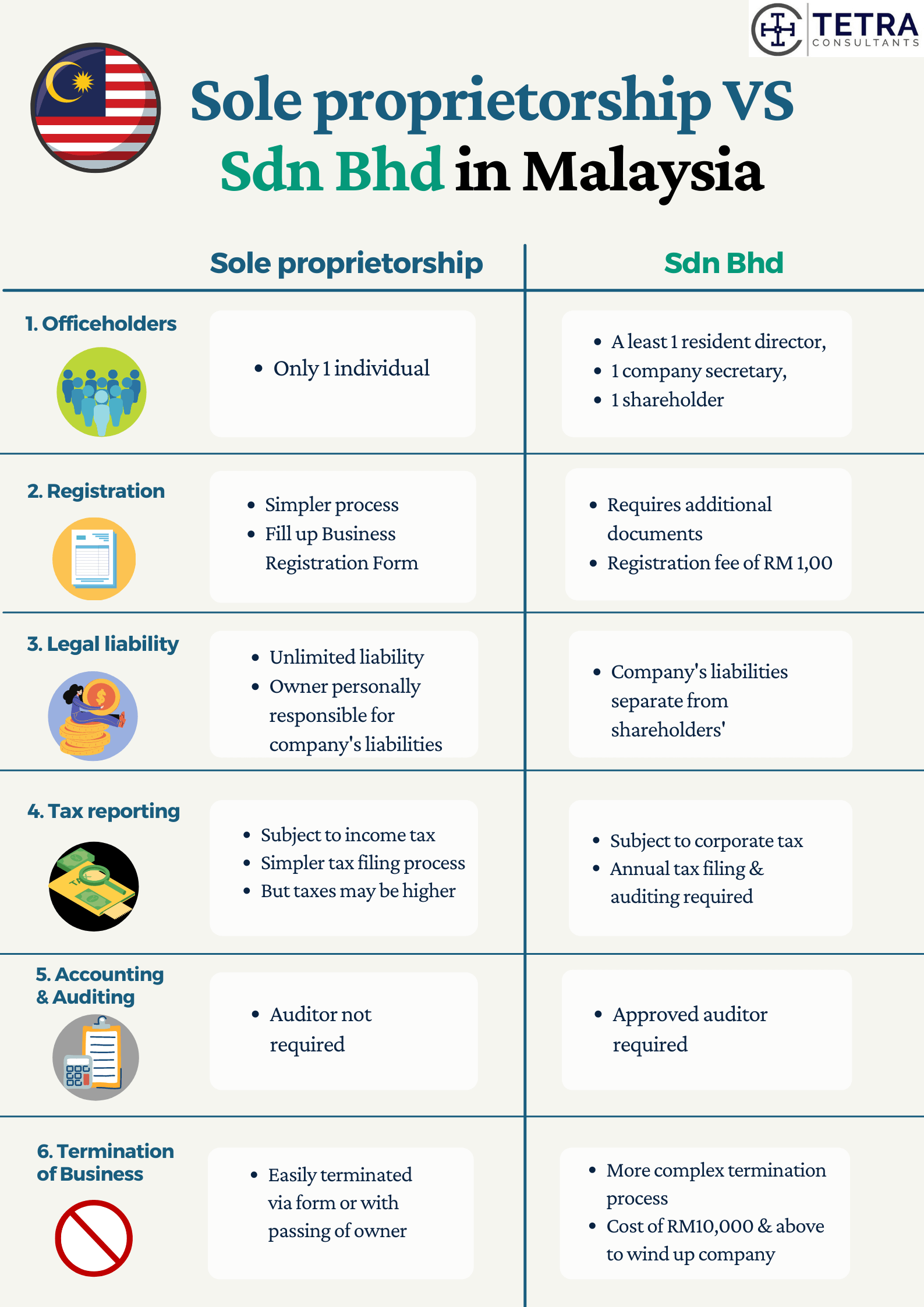

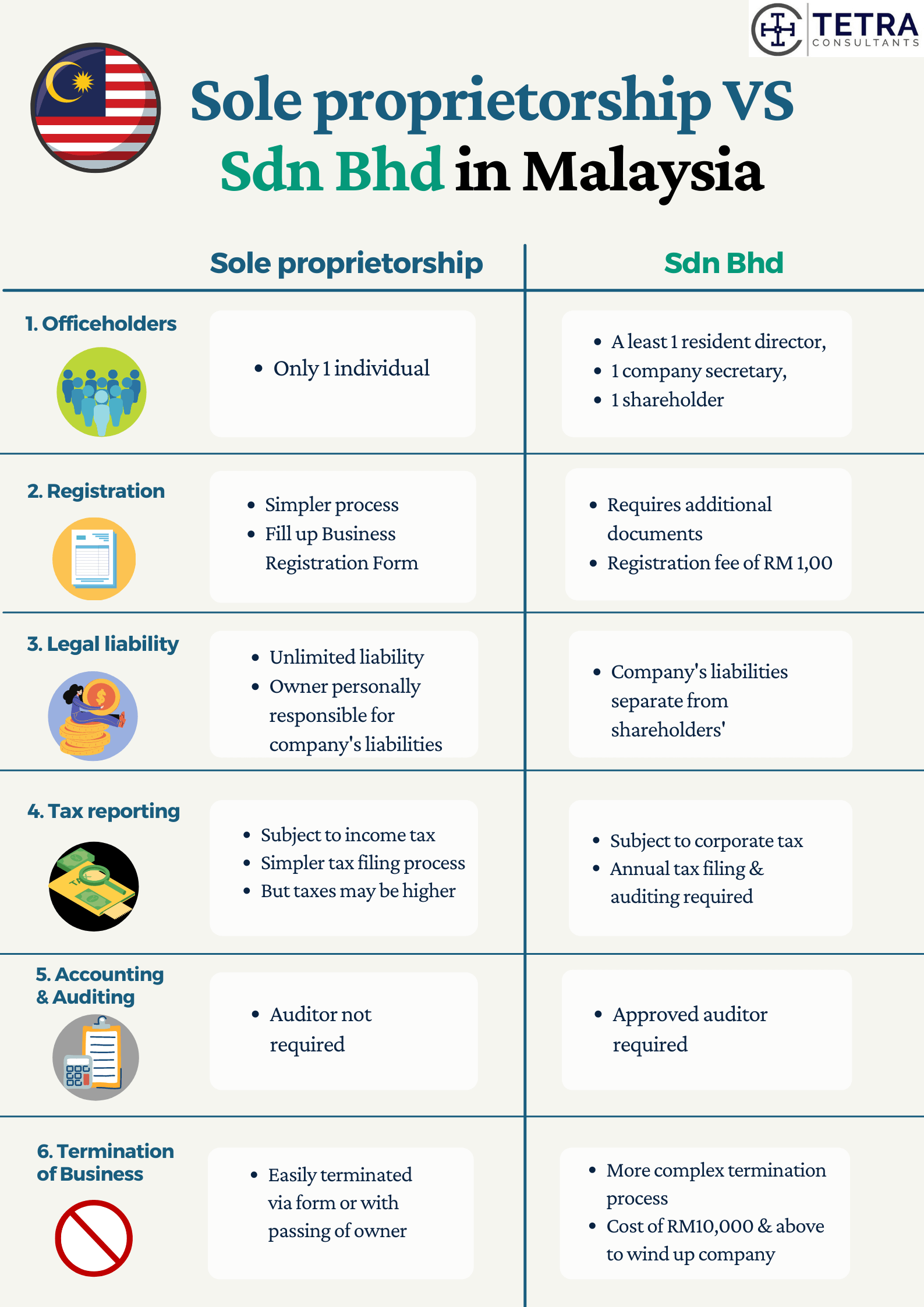

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

0 Response to "Sole Proprietor Income Tax Malaysia"

Post a Comment